[ad_1]

The end of July is the off-season of announcements that precedes the second half of the year. A good time to reflect on the results of the first months of the year, precisely the highlights of our Winners and Losers this week.

Before we present the names that most caught our attention in the technology market in recent days, let’s take a look back at some main events of the past week.

Nothing to see here

One of the news that moved the tech media the most this week was the launch of Ear earphones (1) from Nothing, the startup founded by ex-OnePlus Carl Pei. With a marketing based on the idea of invisible (or ubiquitous/pervasive) computing, the earphones caught our attention for its transparent finish (unlike the initial teaser, shown at the top of the page), besides the competitive price.

We have not tested Ear (1) (yet), but initial reviews indicate that these are headphones with attractive finish and good sound quality, but perhaps without the same impact of the previous startup of the Chinese executive. It’s still too early to assess Nothing’s prospects, but at least they seem much better than those of another startup-with-substantive/adjective/adverb-in-the-name-founded-by-a-badass executive, Essential (remember it?).

Copy it, but don’t do it like it

We’ve already talked in the last two issues about Realme’s magnetic charger, the MagDart. This week, the company revealed teasers about the new accessory and has already set a presentation date for this Tuesday (3).

With a design very reminiscent of the MagSafe (not to mention the name), the MagDart will have its own event, pompously named the “Realme Magnetic Innovation Event.” The published teasers don’t show the fan-powered model that was leaked this week, but honestly, the device in the illustration looked like a prototype fresh out of a 3D printer.

The MagDart event should also showcase the Realme Flash, which has also had a number of teasers leaked, including a post with the words “ocho ocho ocho” (eight eight eight eight, in Castilian), a clear reference to the Snapdragon 888 SoC.

No one is saved

Our editor Benjamin Lucks spoke to digital security experts in recent weeks to explain why Pegasus spyware poses a threat to everyone. The warning was given by WhatsApp CEO Will Cathcart, who said that the danger the spyware poses affects all of us.

After all, Pegasus shows how mass spying programs exploit security flaws traded on underground markets. This creates incentives not to report security bugs to those responsible for systems and devices, which ends up leaving loopholes open (and exploited) for longer.

The problem has much larger implications than I can summarize in two paragraphs, so I recommend reading Ben’s (great) article, which also explains what Pegasus is capable of doing and possible alternatives to trading zero-day flaws.

Winner of the Week: Corporate Financial Reports

This week, the happy-hours for accountants at most tech companies must have been a little more lively than usual – stereotypes aside. With the publication of major companies’ financial statements for the second quarter of 2021, they all seem to have come out winners.

From Apple – which posted its best revenue for a June month – to the LG group – with the highest quarterly revenue in its history, in parallel with the end of the year. From Apple – posting its best revenue for a month in June – to LG – which posted the highest quarterly revenue in its history alongside the end of its mobile phone division operations – the consumer electronics sector seems to have put the difficult year of 2020 behind it.

Samsung Group posted its best second quarter in history, indicating strong performance from its component divisions – the conglomerate’s companies sell AMOLED screens, RAM and flash modules, camera sensors, produce SoCs and GPUs, etc.

All the optimism from the companies, however, gives no sign that this will result in more competition or price drops, as the reports mainly highlighted the good results of the premium and services segments.

In addition, the strong demand for components – and the already commented shortage of semiconductors – does not give signs that companies will be able to balance the production and inventory of chips in the short term.

In addition, the strong demand for components – and the already mentioned semiconductor shortage – does not give signs that companies will be able to balance chip production and inventory in the short term – much to the chagrin of those who are still looking for a video card or video game console (which also announced record sales this week).

Loser of the week: Chinese mobile phone market

While the electronics giants celebrate record sales, the Chinese smartphone market seems in hangover after the strong recovery recorded in the first half of 2021.

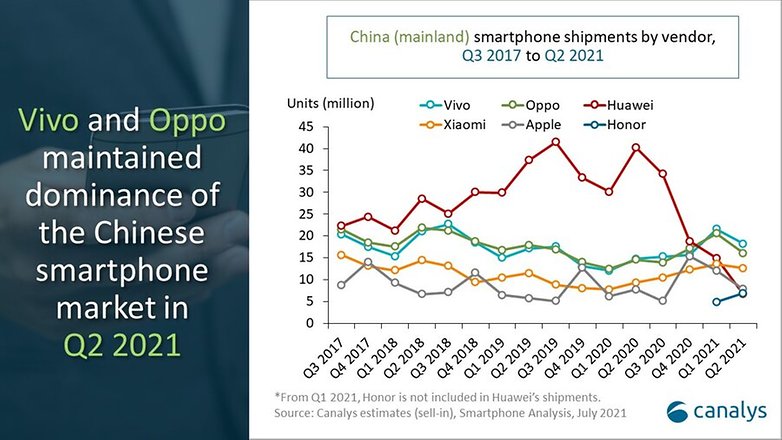

After growing almost 30% between January and March compared to the same period of 2020 (which was affected by the first wave of COVID-19 in China, it is worth noting), the second quarter recorded a 17% drop in 2021 compared to the months of April to June 2020, according to figures from consultancy Canalys.

The company’s analysts pointed out that the Chinese are changing their mobile phones less frequently. In addition, a point of concern identified by Canalys is that the upgrade cycle to 5G should start to slow down.

Despite the sharp decline in the period of the whole market, the 4 manufacturers at the top of the local rankings recorded an increase in sales, with leader Vivo growing 23%. Analysts pointed out that with Huawei’s decline (which went from almost 40% a year ago to less than 10%), the market concentration in the country has fallen, which may stimulate competition between brands.

A segment that still seems open in China is that of Android flagships, still without a clear replacement for the hegemony of the Mate and P lines of Huawei. The Canalys report indicates that the launches of the third quarter can give a sign of how brands intend to take the throne left by Huawei.

And it’s with that mood of anticipation that we wrap up this week’s article. Did you agree with our (broad) choices for the winners and losers? Feel free to disagree and criticize in the comments below. See you next week!

[ad_2]

Source link